Sales Discounts, Returns and Allowances: All You Need To Know

Every company has its policy on how much can be deducted from the sales price due to returns and other factors. Hence, to compensate the client for the inconvenience caused by the delay, the firm offered them a sales allowance as a discount on the project’s total cost. Advanced analytics tools, such as Tableau or Power BI, can be instrumental in this analysis. These platforms allow companies to visualize data trends and drill down into specific categories of allowances. By leveraging these tools, businesses can not only identify problem areas but also measure the effectiveness of corrective actions over time.

Sales Returns and Allowances: Definition

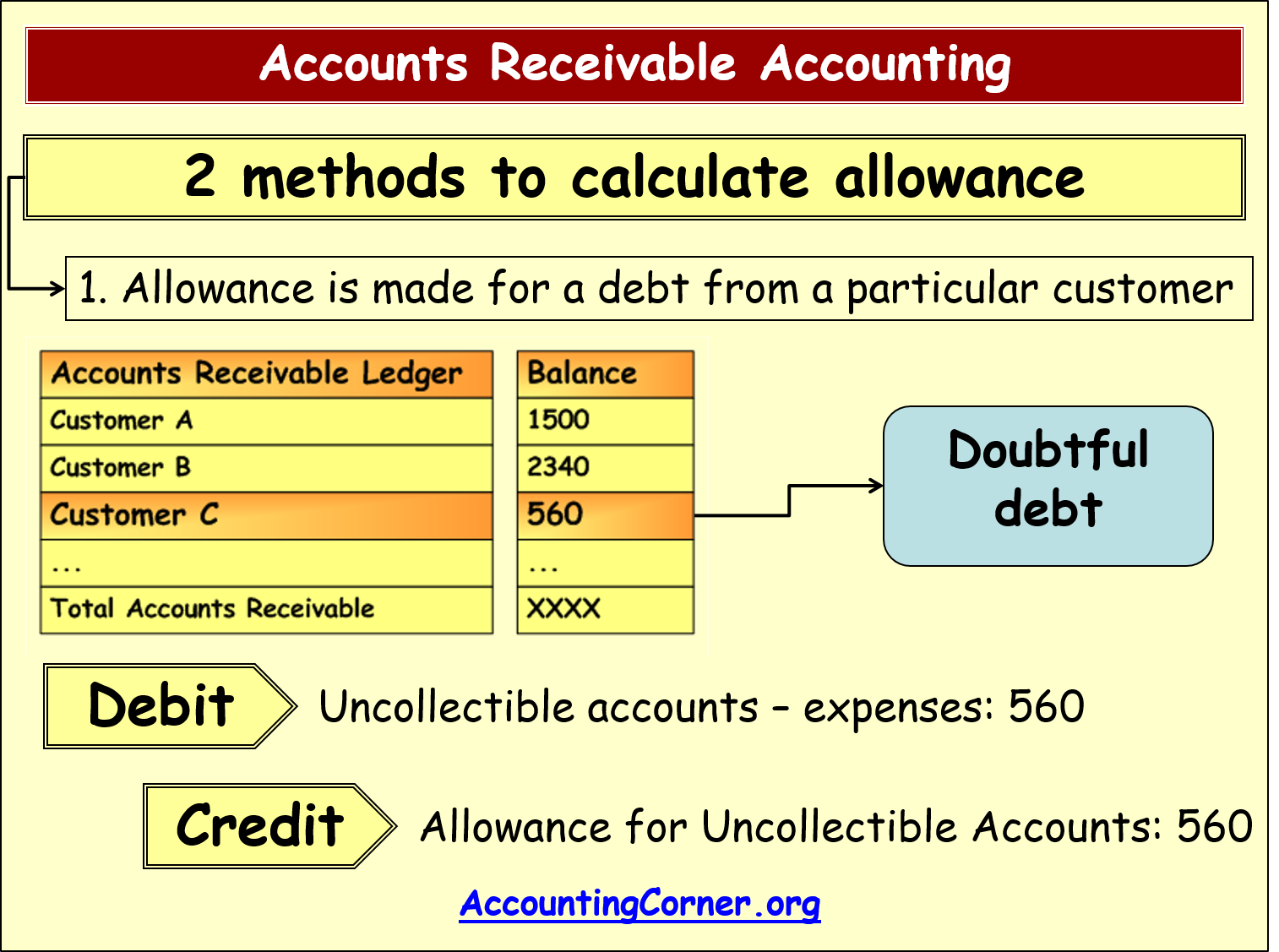

A “sales allowance” refers to a reduction in the selling price of products or services, provided by the seller to the buyer, due to minor defects or deficiencies in the delivered items. It differs from a sales return in that the customer keeps the defective or deficient item, but receives a partial refund or credit as compensation. big four accounting firmss are considered a contra-revenue account, meaning they reduce the total gross sales amount to arrive at net sales. Companies that allow sales returns must provide a refund to their customer.

Configuring Sales Allowances

It is important to establish the policy for your company, but you need to be sure that it will not discourage customers from buying your product or service. Sales allowances are typically used in commercial transactions, such as when a product is returned or not delivered to the buyer. With the $1,000 sales allowance applied, the client will now pay $9,000 instead of the original $10,000 for the custom software development service. Suppose, Elevato, a software development company in the US, offers custom software solutions to their clients.

- It’s critical to understand sales returns and allowances when determining how your business is doing and where it might be going.

- The sales allowance account is a contra account, since it offsets gross sales.

- Establishing clear and consistent sales allowance policies is essential for managing customer expectations and maintaining financial integrity.

Ask a Financial Professional Any Question

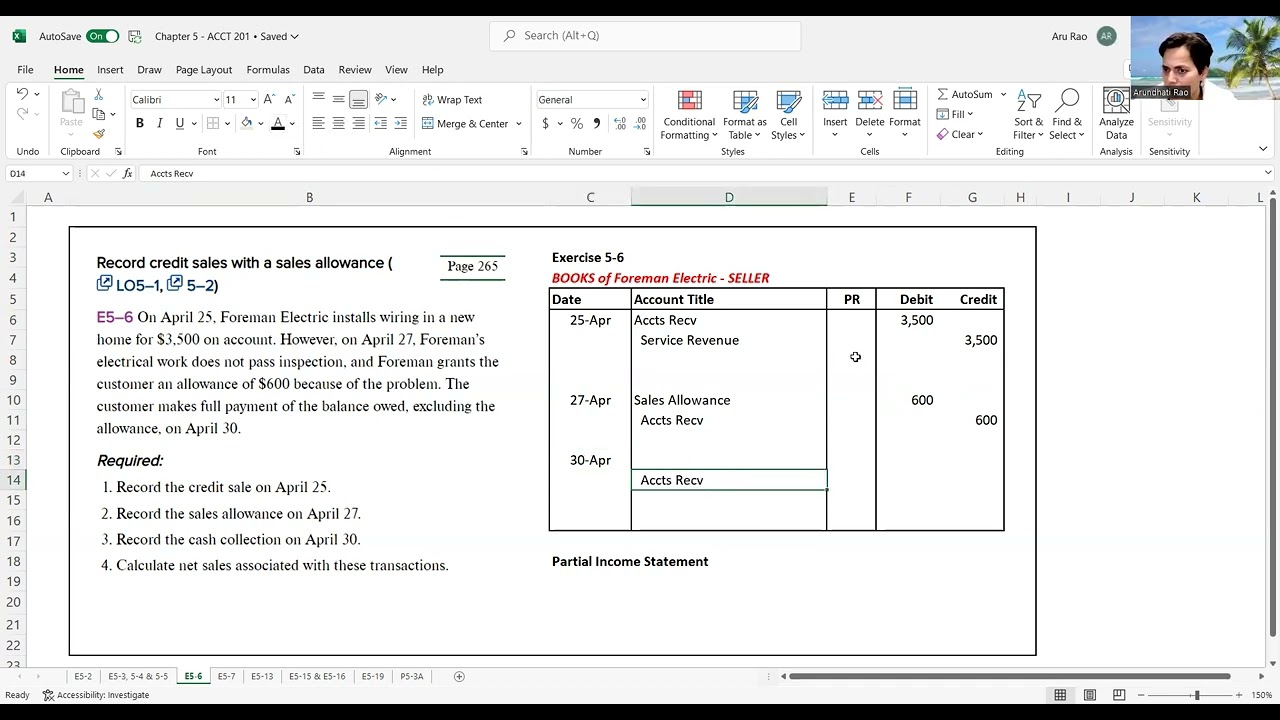

If your returns and allowances are disproportionately high relative to your sales, there could be flaws in your product or the public’s perception of your company. With those terms in mind here’s a picture of how to record sales returns and allowances. Understanding your sales returns and allowances and how to find them rests on your understanding of a couple of terms. The first term is debit, meaning an addition to an expense or asset account or a decrease to a liability or equity account.

Usually, these are a part of the net sales calculation in the notes to the financial statements. Companies do not record this transaction as it does not affect the sales or sales return. During this process, the goods may go under physical changes or deformities. Once customers receive the products, they may not work as intended or suffered damages.

Net sales is the sum of a company’s gross sales minus its returns, allowances, and discounts. They can often be factored into the reporting of top line revenues reported on the income statement. This example demonstrates how sales allowances work in a real-world scenario. Analyzing trends in sales allowances can provide valuable insights into a company’s operational efficiency and customer satisfaction levels.

The firm recently completed a project for a client, and the agreed-upon price was $10,000. However, during the project’s implementation, there was a delay in delivering the final product due to unforeseen technical issues. As a result, the project was delivered two weeks later than initially promised. When only “Net Sales” is presented in the income statement, its computation is shown in notes to financial statements.

Trade discounts usually involve a reduction in price before the sale occurs. Similarly, a sales allowance does not entail a discount for an early payment, which is what cash discounts are. Sales returns and allowances account for one of the most important categories you’ll find on an income statement.

This journal entry carries over to the income statement as a reduction in revenue. Sales returns and allowances are contra revenue accounts in the financial statements. Usually, companies provide a breakup of the contra revenue account to calculate the net sales figure in the income statement. However, companies offer sales allowances before the customer pays for them. Instead, they keep those goods while also receiving a reduction in price for them.