How To Do Bank Reconciliation in 4 Steps Example+Template

The firm’s account may contain a debit entry for a deposit that was not received by the bank prior to the statement date. The Transaction Matching software utilizes AI to discover and configure matching rules, enabling automatic line-level transaction matching between different data sources. Auto-reconciling transactions reduces human errors, such as keying inaccuracies and adds security to the reconciliation process. For some entrepreneurs, reconciling bank transactions creates a sense of calm and balance. If you’re in the latter category, it may be time to think about hiring a bookkeeper who will do the reconciling for you. You can do a bank reconciliation when you receive your statement at the end of the month or using your online banking data.

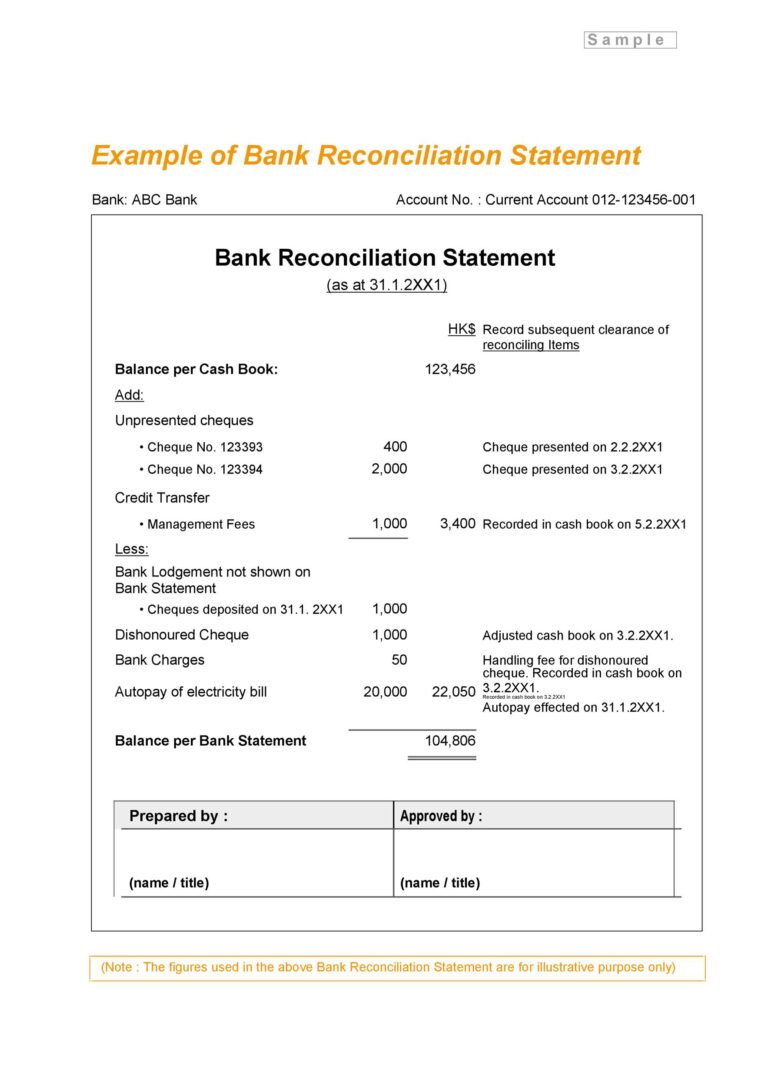

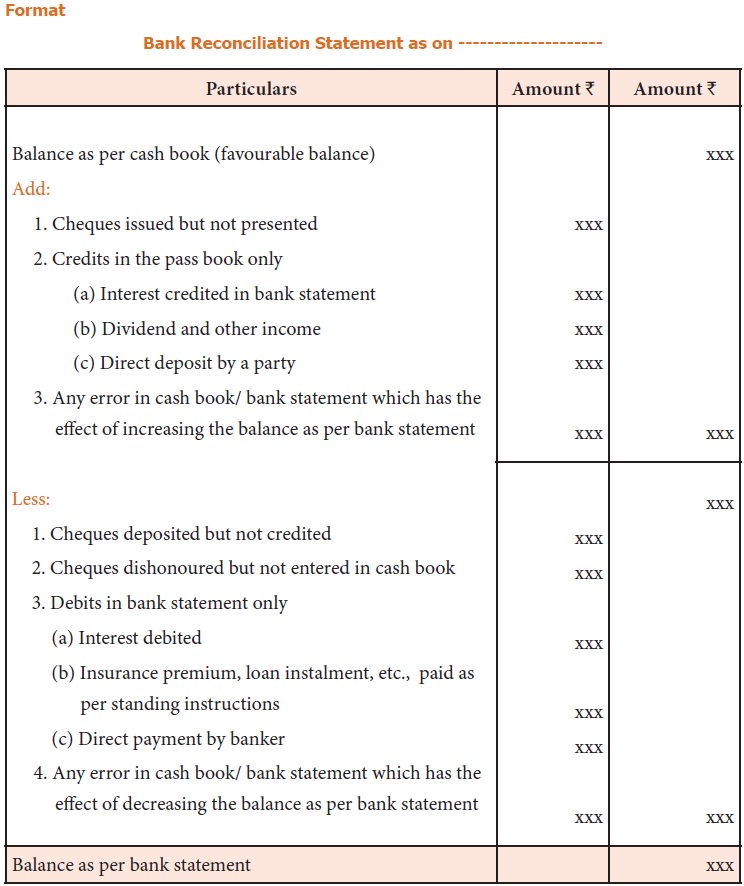

How do you prepare a bank reconciliation statement?

If you want to prepare a bank reconciliation statement using either of these approaches, you can use the balance as per the cash book or balance as per the passbook as your starting point. These fees are charged to your account directly, and reduce the reflected bank balance in your bank statement. These charges won’t be recorded by your business until your bank provides you with the bank statement at the end of every month. Deposits in transit, or outstanding deposits, are not showcased in the bank statement on the reconciliation date. This is due to the time delay that occurs between the depositing of cash or a check and the crediting of it into your account. It’s important to perform a bank reconciliation periodically to identify fraudulent activities or bookkeeping and accounting errors.

Data entry error

Once the underlying cause of the difference between the cash book balance and the passbook balance is determined, you can then make the necessary corrections in your books to ensure accuracy. The frequency of reconciling bank statements depends on the size and complexity of the business and its transaction volume. For larger companies with a high volume of transactions, it’s advisable to reconcile bank statements daily to ensure that any discrepancies or errors are promptly identified and corrected.. Business owners regularly compare their records with bank transactions to ensure there are no errors. It is a best practice that enables them to check that their balance sheet numbers are accurate and match the bank statement.

Identify errors with check deposits

However, the depositor/customer/company debits its Cash account to increase its checking account balance. Next, we look at how a bank uses debit and credit when referring to a company’s checking account transactions. The bank statement submitted by the businessman at the end of May will not contain an entry for the check, whereas the cash book will have the entry. This helps you ensure that all financial records are accurate and up-to-date, facilitating quicker decision-making and issue resolution. Automating bank reconciliation can reduce the cost of processing and auditing. It can also save money by keeping a closer eye on the company’s finances and identifying any discrepancies or errors.

- When all these adjustments have been made to the books of accounts, the balance as per the cash book must match that of the passbook.

- Errors in calculation or recording of payments are more likely made by business staff than by a bank.

- Once the underlying cause of the difference between the cash book balance and the passbook balance is determined, you can then make the necessary corrections in your books to ensure accuracy.

Bank errors are mistakes made by the bank while creating the bank statement. Common errors include entering an incorrect amount or omitting an amount from the bank statement. These miscalculations can also occur on the business’s financial records.

This way, you can ensure your business is in solid standing and never be caught off-guard. This is a simple data entry error that occurs when two digits are accidentally reversed (transposed) when posting a transaction. For example, you wrote a check for $32, but you recorded it as $23 in your accounting software. The deposit could have been received after the cutoff date for the monthly statement release.

After all reconciliation adjustments, the final correct cash balance captured in the company accounting records and on its balance sheet as at 30 September 20XX was $2,000. To create a bank reconciliation, you will need to gather your bank preparing a bank reconciliation statements and reconcile them with your accounting records (ledger). A bank reconciliation statement is a document that is created by the bank and must be used to record all changes between your bank account and your accounting records.

Read on to learn about bank reconciliations, use cases, and common errors to look for. Compare your personal transaction records to your most recent bank statement. First, make sure that all of the deposits listed on your bank statement are recorded in your personal record.